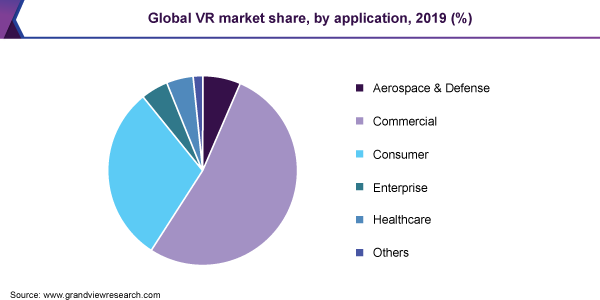

This study assesses VR applications for the consumer and enterprise sectors that are leading the way in gaming, education, and simulation training. The report evaluates leading businesses, strategies, goods, and services. It provides analysis and forecasts for 2021 through 2026 for VR gaming, education, and simulations.

We see fully immersive systems of virtual reality gaining substantial market momentum in the next few years in consumer markets. These VR systems will provide humans with an unprecedented digital experience, often including multiple senses and virtual object interaction and/or real-world and virtual interaction.

We see current VR gaming developing from current offerings such as HTC Vive, Oculus Rift, and PlayStation VR in terms of the consumer segment to more sophisticated entertainment that includes casual gaming components combined with real-world interests involving the economy and social status.

VR gaming is a greenfield opportunity in many respects, which will bring many new market entrants into the fray as application and content suppliers compete aggressively to establish a loyal user base. For instance, Skydance recently unveiled The Walking Dead: Saints & Sinners, initially available on Oculus Rift, Rift S, Quest, and HTC Vive Interactive, a division of Skydance Media.

Successful businesses will be those that develop interest groups based on game-play and follower dynamics, including interactive e-sports entertainment innovation, in-game reward systems, and VR gamification integration in the actual world. Long-term success will depend on the platform, system, and independence of connectivity for game delivery. This will coincide with a few key platform/network conversion and service delivery trends, such as the shift from console to cloud-supported platforms and edge computing-supported 5G communications.

Over the next three to five years, we expect some very interesting enterprise VR applications to emerge. Many of these will be solution-focused on achieving very specific internal business objectives such as risk mitigation, reduction of expenses, and training of employees. Enterprise applications, as companies embrace the use of VR to reach consumer markets, will extend beyond internal use and B2B. Real estate is a prime example of VR being used for educational sales, such as training new home buyers while marketing properties at the same time.

Once 5G is more firmly in place commercially, we see the market for virtual reality gaining ground, but not entirely because of wireless VR. Instead, as one of the fundamental drivers for VR adoption, we see a massive build-out of broadband (because of competition from the 5G market). We will drive this in part by substantially higher FTTX and HFC availability, and higher overall spare capacity at lower costs.

For enhanced consumer wireless services such as augmented reality, virtual reality, and cloud gaming, 5G will act as a launchpad. Previously burdened by a combination of technology gaps and consumer readiness issues, we poise the market for virtual reality for substantial global growth, providing service providers, content developers, and ecosystem component providers with abundant opportunities.

While many apps and services in the XR universe today are very device-dependent and network-restricted, convergence from a device perspective is on the horizon and significant possibilities through untethering via 5G and Mobile Edge Computing (MEC). To support latency-sensitive applications and services, MEC will be important in various cases of consumer, enterprise and industrial use. This will be the case for VR portability in particular, and mobility if there is good 5G coverage to some extent.

Many improved applications will lead significantly lower latency facilitated by the combination of 5G and MEC. VR-based telepresence, for example, will eventually become the norm, starting with Zoom-like private enterprise solutions and the SMB markets.

There will also be support for Ultra High Definition (UHD) audio communications, streaming video, and ultra-clear voice communication for virtual reality applications and services of the next generation through Voice over 5G (Vo5G). Vo5G will benefit VR in many respects for consumer and business applications, such as UHD becoming the norm in immersive experiences.

Select Findings Report:

5G will serve as a launchpad for improved wireless services for consumers, such as augmented reality, virtual reality and cloud gaming.

We see everything from situational to more conventional expectations for training and training, such as VR enhanced flight and vehicle training simulations.

VR solution-focused offers will concentrate on very specific internal business objectives such as risk mitigation, cost reduction, and training of employees.

To support latency-sensitive applications and services for various consumer, business and industrial use cases, edge computing will be important.

Benefits to report:

In gaming, education, and simulation analysis and forecasts for VR

Understanding the VR environment, including facilities, platforms and services Identify the leading suppliers, strategies, products, apps and services for VR.

Understand the drivers of the VR market, including economic factors, adoption, and use Mentioned Firms

Simbionix's 3D Systems

Inc. of Analog Devices.

Corp. Avegant.

BARCO BARCO

Systems CyberGlove

Semiconductor Corp for Cypress

Reality Inc. EON.

To Facebook

Inc. of FOVE.

Inc. Google.

Corporation HTC

Technologies for Huawei

Technology for Integrated Devices Inc

Corporation Intel

Inc. of Leap Motion.

Corporation LG

Leap of magic

Integrated Maxim

Corporation of Microsoft

NextVRR, NextVR

Corporation NGRAIN (mCloud)

Inc. of Niantic.

Nokia — Nokia

Corporation NVidia

NXP-NXP

Inc. of Qualcomm.

Semiconductor Rohm

Samsung Co. of Electronics Ltd, ltd.

Corporation Semtech

Inc. of Sixense Entertainment.

Telecom SK

Corporation Sony

StreamVR, StreamVR

The Texas Instruments

Technologies for Unity

V-REAL: V-REAL

VIRTALISOUS

Company for Virtual Reality (VRC)

Corporation Vuzix

Wevr Wevr

WorldwideViz

From Zeiss VR One

Corporation ZTE

You should also check out the following articles:

- VR BUYING GUIDE AND THE BEST VR HEADSET FOR 2022

- A meta market opportunity: The metaverse could soon be worth $1 trillion

- Facebook wants to build a metaverse. Microsoft is creating something even more ambitious.

- How to succeed in the virtual reality world of tomorrow?

- Books you must read about virtual reality

- Best New Augmented Reality Books To Read In 2021

- US$ 4.7 Billion- The global augmented reality gaming market

- The smart glasses revolution is about to get real

- Consumer Brands Reinventing Marketing in the Metaverse

- Imagine Making Money in Rec Room

- The biggest AR and VR predictions of 2022

- Apple hired Meta's AR communications lead ahead of the 2022 launch of the headset.

- Who Will Be in Charge of the Metaverse?

- The Kingdom of Abraham: The first Jewish metaverse

- Gen Z are planning to spend thousands on cryptocurrency, NFTs and metaverse

- According to Goldman Sachs, the metaverse must run on blockchain

- What You Can Create With a Small Piece of Land in the Metaverse

- How To Buy Land In The Metaverse?